ohw much tax chanel canada | 2024 Personal tax calculator ohw much tax chanel canada Calculations are based on rates known as of October 31, 2024. Increased inclusion rate for capital gains has been included, but changes may be required. 2025 tax brackets and tax credits are . The Twinning is a level 80 side dungeon in Final Fantasy 14. Originally added in patch 5.0 with the release of Shadowbringers, this dungeon will have you explore the depths of the First's Crystal Tower. Related: .

0 · Salary Calculator Canada

1 · Income tax rates for individuals

2 · Income Tax Calculator for 2023 and 2024

3 · Income Tax Calculator 2024: Estimate Your Taxes

4 · Canada’s income tax brackets for 2024, plus the maximum tax

5 · Canada’s income tax brackets for 2023, plus the maximum tax yo

6 · Canada income tax calculator 2023

7 · Canada Income Tax Calculator 2024

8 · 2024 and 2025 Canadian Tax Calculator

9 · 2024 Personal tax calculator

By Daniella Lucas. last updated 10 October 2022. Reach the Final Fantasy XIV level cap fast with these tips, bonuses and items. Comments. (Image credit: Square Enix) This FFXIV leveling.

Use our Canada Salary Calculator to find out your take-home pay and how much tax (federal tax, provincial tax, CPP/QPP, EI premiums, QPIP) you owe.Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Plus, explore Canadian and provincial income tax FAQ and resources from TurboTax.

Use our income tax calculator to estimate how much you’ll owe in taxes. Enter your income and other filing details to find out your tax burden for the year.2024 Personal tax calculator. Calculate your combined federal and provincial tax bill in each province and territory. The calculator reflects known rates as of June 1, 2024.Calculations are based on rates known as of October 31, 2024. Increased inclusion rate for capital gains has been included, but changes may be required. 2025 tax brackets and tax credits are . Want an idea of how much tax you paid—or will be paying—for 2024? Here are the federal and provincial tax brackets to help you prepare for tax season.

Estimate your take home pay after income tax in Canada with our easy to use 2024 income tax calculator.

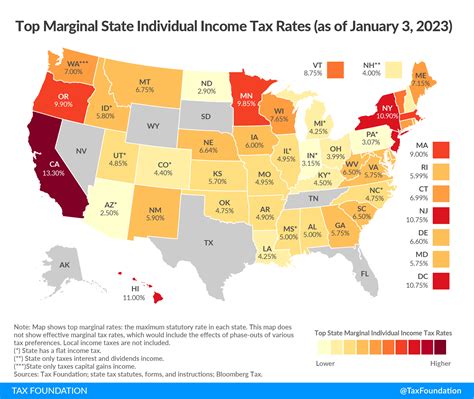

The Government of Canada sets the federal income tax rates for individuals. Each province and territory determines their own income tax rates. Provincial or territorial income tax rates apply .

Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces. Find out your tax brackets and how much Federal and Provincial .Use our Canada Salary Calculator to find out your take-home pay and how much tax (federal tax, provincial tax, CPP/QPP, EI premiums, QPIP) you owe.Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Plus, explore Canadian and provincial income tax FAQ and resources from TurboTax.

That means you will pay 15% in federal tax on your ,000 of income—that’s ,500, not including deductions and claims of course. To give an another example, in November 2023, the average .2024 Personal tax calculator. Calculate your combined federal and provincial tax bill in each province and territory. The calculator reflects known rates as of June 1, 2024.

Use our income tax calculator to estimate how much you’ll owe in taxes. Enter your income and other filing details to find out your tax burden for the year.

Want an idea of how much tax you paid—or will be paying—for 2024? Here are the federal and provincial tax brackets to help you prepare for tax season.Calculations are based on rates known as of October 31, 2024. Increased inclusion rate for capital gains has been included, but changes may be required. 2025 tax brackets and tax credits are based on our calculation of indexation. 2024 tax brackets .

The Government of Canada sets the federal income tax rates for individuals. Each province and territory determines their own income tax rates. Provincial or territorial income tax rates apply in addition to federal income tax rates. On this page. 2024 federal income tax rates. 2024 provincial and territorial income tax rates. Estimate your take home pay after income tax in Canada with our easy to use 2024 income tax calculator.

If you’re looking for information on dimensions, size names, leathers or hardware, the Classic Flap’s Ultimate Bag Guide is the place to look; as a supplement to that, we’ve created an international price guide for eight prominent global fashion markets, which you can find below.Use our Canada Salary Calculator to find out your take-home pay and how much tax (federal tax, provincial tax, CPP/QPP, EI premiums, QPIP) you owe.

Salary Calculator Canada

Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Plus, explore Canadian and provincial income tax FAQ and resources from TurboTax.That means you will pay 15% in federal tax on your ,000 of income—that’s ,500, not including deductions and claims of course. To give an another example, in November 2023, the average .2024 Personal tax calculator. Calculate your combined federal and provincial tax bill in each province and territory. The calculator reflects known rates as of June 1, 2024.Use our income tax calculator to estimate how much you’ll owe in taxes. Enter your income and other filing details to find out your tax burden for the year.

Want an idea of how much tax you paid—or will be paying—for 2024? Here are the federal and provincial tax brackets to help you prepare for tax season.Calculations are based on rates known as of October 31, 2024. Increased inclusion rate for capital gains has been included, but changes may be required. 2025 tax brackets and tax credits are based on our calculation of indexation. 2024 tax brackets .The Government of Canada sets the federal income tax rates for individuals. Each province and territory determines their own income tax rates. Provincial or territorial income tax rates apply in addition to federal income tax rates. On this page. 2024 federal income tax rates. 2024 provincial and territorial income tax rates. Estimate your take home pay after income tax in Canada with our easy to use 2024 income tax calculator.

fendi baby stroller pram

fendi baby car seat price

North thanalan is by far the fastest way from 48-50 assuming there are enough people there. If your only getting 8k your doing something major wrong. Those fates give about 27-28k at level.

ohw much tax chanel canada|2024 Personal tax calculator